Dear Eaton County voters,

In last night’s election, the voters supported the Eaton RESA special education millage which will benefit all students, in all school districts, across our area.

The millage will generate $3 million of dedicated special education funds each year over the next ten years to improve services, increase programs, bolster staffing, purchase equipment and provide services to students. With the increase in special education funding, more general education funds will be available to our districts to provide specialized programs like robotics, support student mental health and wellbeing and other needs of each individual district.

Thank you to the voters for supporting this millage and to the local district leaders who helped inform the public and educate our community about the millage. We appreciate your trust in our ability to administer this funding appropriately and responsibly and our local district’s ability to provide the highest quality services to all students.

Sincerely,

Dr. Sean Williams

Specia l Education Millage

l Education Millage

November 7, 2023

The amount of special education services and the way students receive services has changed since 1985 when voters first approved the special education millage. Not only have costs for services increased, but tools and technology improvements have evolved and supported student learning in ways that were not possible in 1985. Nearly 15% of students, ages birth to 26 years old, receive some form of special education services in the Eaton RESA service area.

Federal, state and local special education revenues underfund Eaton RESA service area programs by nearly $6.1 million dollars annually. Without additional millage funds, local school districts are forced to use general education funds to pay for special education programs and services.

If this proposed millage passes, the cost to homeowners would be .9 mills, or approximately $.25/day, $7.50/month, or $90/year for a home with a taxable value of $100,000 (or market value of $200,000).

If approved, this restoration would generate $3 million of special education funds annually for 10 years to support students, purchase equipment, and decrease the amount of general education funds that are being used to supplement special education costs. In the Eaton RESA service area.

If approved, this millage would restore the current special education millage that has been reduced (0.3288) due to the Headlee Rollback from the full amount originally approved by voters in 1985. In addition, .5712 would be added to the current special education millage for a total of .9 mills generating approximately $3 million each year over the next 10 years.

- Headlee Restoration: 0.3288

- Special Education: 0.5712

Total Millage Request: 0.9

Student receive special education supports for a variety of needs and are eligible for services under one of 13 disability areas, including:

- Autism Spectrum Disorder (ASD)

- Physical Impairment

- Cognitive Impairment

- Severe Multiple Impairment

- Deaf-Blindness

- Specific Learning Disability

- Deaf or Hard of Hearing

- Speech and Language Impairment

- Early Childhood Developmental Delay

- Traumatic Brain Injury

- Emotional Impairment

- Visual Impairment

- Other Health Impairment

On May 17, 2023, The Eaton RESA Board of Education authorized the district to add a .9 mills Special Education Millage on the ballot on November 7, 2023. The Board of Education members represent five public school districts: Charlotte Public Schools, Eaton Rapids Public Schools, Grand Ledge Public Schools, Maple Valley Public Schools, and Potterville Public Schools.

If approved by voters, the grid illustrates the increase in funding by district (based on 2022-23 needs):

| District | Enrollment | Annual Increase | Per Pupil Increase | Over 10 Years |

| Charlotte | 2,378 | $624,427 | $262 |

$6.2 million |

| Eaton Rapids | 1,982 | $661,246 | $333 |

$6.6 million |

| Grand Ledge | 5,096 | $1,289,880 | $253 |

$12.9 million |

| Maple Valley | 912 | $226,727 | $248 |

$2.2 million |

| Potterville | 753 | $248,880 | $330 |

$2.4 million |

![]() Special Education Millage Community Presentation

Special Education Millage Community Presentation

![]() About the SE Millage (Printable version)

About the SE Millage (Printable version)

What Would This Cost Me as a Taxpayer?

If this proposed millage passes, the cost to homeowners would be .9 mills, or approximately $7.50/month or $90/year for a home with a market value of $200,000 (or taxable value of $100,000).

Ballot Language

Eaton Regional Education Service Agency Special Education Millage Proposal

This proposal will increase the levy by the intermediate school district of special education millage previously approved by the electors. Shall the limitation on the annual amount of property tax which may be assessed against all property within the Eaton Regional Education Service Agency, Michigan, previously approved in 1985 by the electors for the education of students with a disability be increased by .9 mill ($0.90 on each $1,000 of taxable valuation) for a period of 10 years, 2024 to 2033, inclusive; the estimate of the revenue the intermediate school district will collect if the millage is approved and levied in 2024 is approximately $3,051,828 from local property taxes authorized herein (.3288 mill of the above is a restoration of millage lost as a result of the reduction required by the Michigan Constitution of 1963 and .5712 mill is an increase above the previously approved millage level)?

A visual representation of the ballot language is also available.

Breaking Down the Nov. 7 Millage Language

The Special Education Millage proposal would increase the levy of the intermediate school district of special education millage previously approved in 1985 by the electors.

| Ballot Language | Explanation |

|---|---|

| Shall the limitation on the annual amount of property tax which may be assessed against all property | The proposed millage would apply to all taxable properties in the Eaton RESA service area including Principal Residence Exemption (PRE) properties. |

|

within the Eaton Regional Education Service Agency, Michigan, previously approved in 1985 by the electors for the education of students with a disability... |

The Eaton RESA service area includes the Charlotte, Eaton Rapids, Grand Ledge, Maple Valley, Onieda-Strange and Potterville school districts. |

| be increased by .9 mill ($0.90 on each $1,000 of taxable valuation) for a period of 10 years, 2024 to 2033, inclusive;... |

The proposed millage increase is .9 mils for 10 years ($.90 on each $1,000 of taxable valuation). |

| the estimate of the revenue the intermediate school district will collect if the millage is approved and levied in 2024 is approximately $3,051,828 from local property taxes authorized herein... |

The proposed millage would collect approximately $3 million per year in the first year and similar annual funding each year for 10 years. |

| (.3288 mill of the above is a restoration of millage lost as a result of the reduction required by the Michigan Constitution of 1963 and .5712 mill is an increase above the previously approved millage level)? |

A restoration millage, as well an additional increase millage, are proposed to realign special education funding with the current budget needs. Headlee Restoration: .3288 |

![]() Ballot Language (Printable version)

Ballot Language (Printable version)

Frequently Asked Questions

Q: What is on the ballot?

A: A ten-year special education millage proposal of .9 mills per year. If approved, the proposed millage would generate approximately $3 million per year for 10 years to support special education in all school districts in the Eaton RESA service area.

![]() Special Education Millage Q&A (Printable version)

Special Education Millage Q&A (Printable version)

Q: How would districts use the funds collected from this millage?

A: If approved, this restoration would generate $3 million of special education funds annually to support students, purchase equipment, and decrease the amount of general education funds that are being used to supplement special education costs. In the Eaton RESA service area, nearly 15% of students receive special education.

Q: Why are additional funds needed?

A: Special education programs and services provided in the Eaton RESA service area school districts are underfunded by nearly $6.1 million annually. This millage would not fully fund special education. However, it would reduce the amount that is being used from general education to fund special education, returning approximately $3 million annually to general education.

Q: Why are general education funds being used to pay for special education?

A: Local school districts are mandated by law to provide special education programs and services; however, federal and state governments have not adequately funded special education in the past, placing the burden on local and intermediate school districts. Without additional millage funds, local school districts are forced to use general education funds to pay for special education programs and services.

Q: How much will the proposed millage cost residents?

A: If approved, a taxpayer who owns a home with a market value of $200,000 (taxable value of $100,000) would pay $7.50 per month or $90 per year. The funds generated from this restoration would support students in special education.

Q: Will my home property taxes go down if this is defeated?

A: No, taxes will not be reduced.

Q: Who can vote in this election?

A: Every registered voter who lives in the school districts of Charlotte, Eaton Rapids, Grand Ledge, Maple Valley, Oneida Strange, and Potterville, whether a property owner or not, is eligible to vote.

Q: What has changed since the 1985 millage was voted on by voters?

A: Below are a few examples of areas that have changed:

- Expanded center-based programming including emotionally impaired programs for K-12 students

- Programming for elementary students with Autism Spectrum Disorder

- Expanded transition programs focused on post-secondary outcomes

- School year and summer work experience programs including student-run businesses and independent living skills

- Technology tools have expanded to support communication and learning

Q: Why is this on the ballot?

A: Federal, state and local special education revenues underfund Eaton RESA service area

programs by nearly $6.1 million dollars annually.

Local school districts are mandated by law to provide special education programs and

services; however, federal and state governments have not adequately funded special

education in the past, placing the burden on local and intermediate school districts.

Without additional millage funds, local school districts are forced to use general education

funds to pay for special education programs and services.

Q: Why is this on the ballot under Eaton RESA if the funds would support students in all the local districts?

A: Eaton RESA is the only educational entity in Eaton County that can place this proposal on the ballot and is doing so on behalf of, and with the cooperation with, the local school districts.

Eaton RESA provides direct special education services, including speech, occupational therapy, ASD programs, transportation, adaptive technology and more to local districts as well as distributes funds to local districts through the Special Education Funding system.

Q: When do I vote?

A: On November 7, 2023 or by absentee ballot.

Q: Where can I find out more information about voting?

A: The State of Michigan Secretary of State’s office has a Voter Information website for more details.

Q: What is a millage?

A: Intermediate School Districts, also known as Regional Educational Service Agencies, levy special education millages to pay for the special education services they provide directly or that they pay other school districts to provide. This is in the form of a percentage per $1,000 taxable home value.

Q: What is a Headlee Restoration?

A: In 1978, Michigan voters approved an amendment to the Michigan Constitution known as the Headlee Amendment. This amendment included a number of provisions related to state and local taxes, including those which support schools.

The state-created Headlee Amendment caps property tax increases at the rate of inflation. When the taxable values of properties rise faster than the rate of inflation, the actual tax levy is rolled back. As a result of a Headlee Rollback, schools collect less revenue than originally approved by voters.

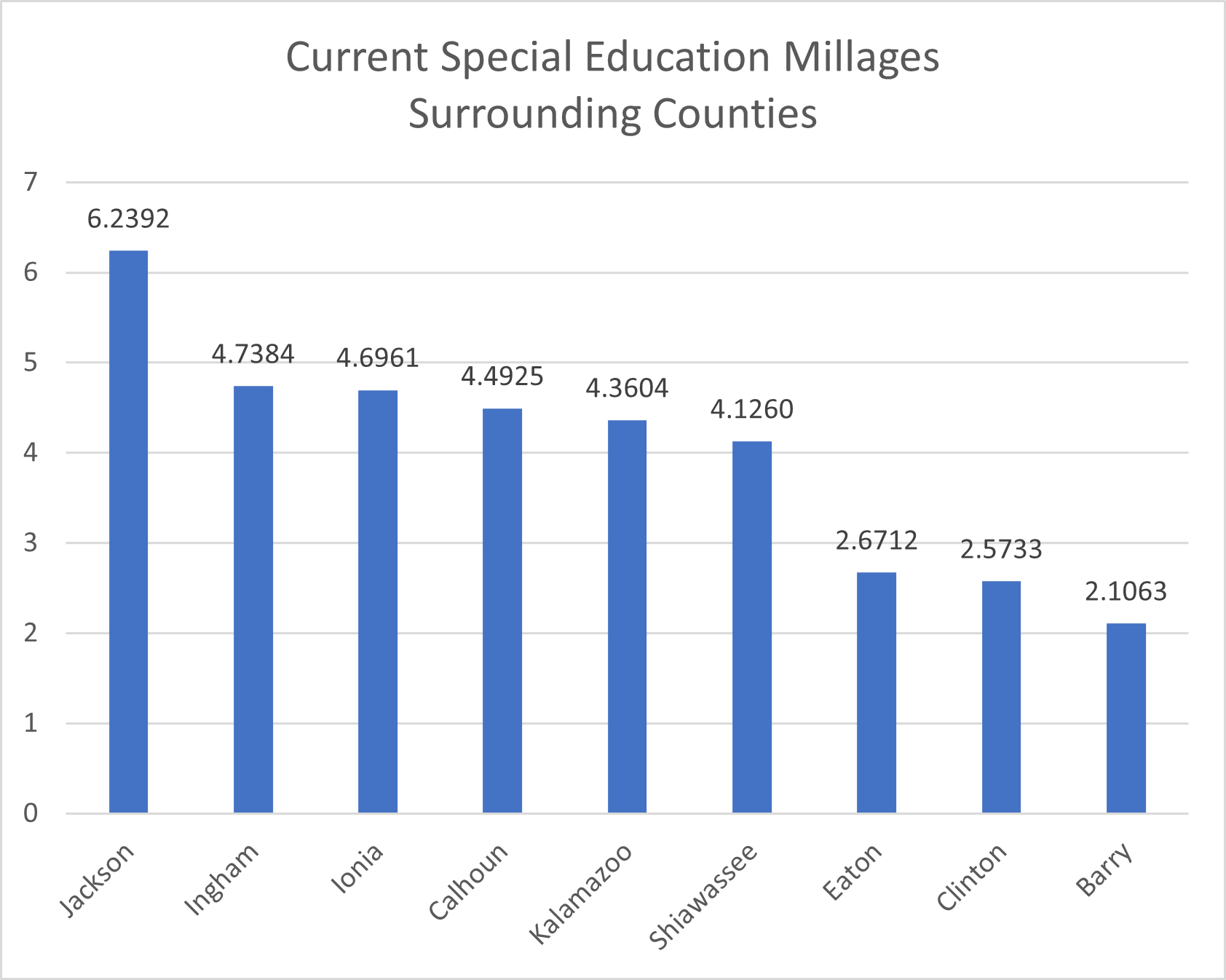

Q: How does this millage compare to those in other counties in Michigan?

A: Several Michigan counties have special education millages. The list below shows current millages for surrounding counties. (Source: 2022-23 State Aid Financial Status Report)

- Jackson: 6.2392 mils

- Ingham: 4.7384 mils

- Ionia: 4.6961 mils

- Calhoun: 4.4925 mils

- Kalamazoo: 4.3604 mils

- Shiawassee: 4.1260 mils

- Eaton: 2.6712 mils

- Clinton: 2.5733 mils

- Barry: 2.1063 mils

State Funding Explained

The State just passed an education budget that increased funding for the 2023-24 school year, is this millage still necessary?

School districts are required, by law, to provide special education services to students. The State of Michigan is required to reimburse school districts for a portion of their special education costs. Beginning with the 2023-24 school year, the State of Michigan is increasing the reimbursement. Even with the anticipated increase, there will still be a shortfall of $6.1 million for school districts in Eaton RESA’s service area.

The State of Michigan is required to reimburse school districts for a portion of their special education costs. Beginning with the 2023-24 school year, the State of Michigan is increasing the reimbursement to local districts, but makes up only part of the funds required. The remaining funding for special education comes from federal grant dollars, millage funds and from funds allocated for general education and operations.

In order to lessen the $6.1 million shortfall in special education funding, Eaton RESA is proposing a .9 mill millage to support special education programs across the Eaton RESA service area. If successful, the millage would provide an additional $3 million dollars per year for 10 years.

| School Year | Percent Reimbursed by the State to Eaton RESA | Special Education Shortfall |

|---|---|---|

| 2022-23 | 75% of required 28.613% (actual reimbursement rate of 21.4%) |

$6.8 million |

| 2023-24 |

100% of required 28.613% |

$6.1 million |

The scenario below outlines the state special education reimbursement a district would receive if they submitted expenses totaling $500,000. Additional reimbursement is collected from federal grant program, local millages and is supplemented by general education funds.

Scenario

Amount submitted for reimbursement: $500,000

Amount paid by state funds 2022-23 (reimbursed at 75% of required): $80,000

Amount paid by state funds 2023-24 (reimburse at 100% of required 328.613%): $143,065

![]() State Funding Explained (Printable version)

State Funding Explained (Printable version)